Absolutely! Here’s a 2700-word article on no credit check embroidery machine financing, incorporating your request to replace “ with `

` or `

` for headings.

The world of embroidery is a captivating blend of artistry and entrepreneurship. Whether you’re a seasoned crafter looking to expand your business or a budding enthusiast eager to explore a new creative avenue, an embroidery machine is a crucial investment. However, the upfront cost can be daunting, especially if you have a less-than-perfect credit history. This is where no credit check embroidery machine financing comes into play, offering a viable pathway to turn your embroidery dreams into reality.

Traditional financing options, such as bank loans or credit cards, heavily rely on credit scores. Individuals with limited credit history, past financial setbacks, or simply those who prefer to avoid credit checks often find themselves excluded from these conventional avenues. This creates a significant barrier for aspiring embroiderers, particularly those who are self-employed or running small businesses.

No credit check financing bridges this gap by focusing on factors other than credit scores, such as income, business revenue, or collateral. This approach opens doors for individuals who may have been previously denied financing, allowing them to access the equipment they need to pursue their passion and build their business.

Several types of no credit check financing options are available for embroidery machines, each with its own set of requirements and benefits.

Rent-to-Own Programs

Rent-to-own programs are a popular choice for individuals with limited or no credit. These programs allow you to rent an embroidery machine for a specified period, with the option to purchase it at the end of the rental term.

You select an embroidery machine from a participating retailer.

No credit check is required.

The total cost of the machine may be higher than if you purchased it outright.

Lease-to-Own Programs

Lease-to-own programs are similar to rent-to-own, but they often involve longer terms and a more formal agreement. These programs are often favored by businesses looking to acquire equipment without a significant upfront investment.

You select an embroidery machine from a leasing company.

No credit check is typically required.

The total cost of the machine may be higher than if you purchased it outright.

Merchant Financing

Some embroidery machine retailers offer in-house financing programs that cater to customers with varying credit profiles. These programs may include no credit check options or flexible payment plans.

You purchase an embroidery machine directly from the retailer.

Convenient one-stop shopping.

Interest rates may be higher than traditional financing.

Alternative Lenders

A growing number of alternative lenders specialize in providing financing to individuals and businesses with limited or no credit. These lenders often focus on factors such as business revenue, cash flow, and collateral.

You apply for financing through an online or brick-and-mortar lender.

Wider range of financing options.

Interest rates may be higher than traditional lenders.

When selecting a no credit check financing option, it’s essential to consider several factors to ensure you make an informed decision.

Total Cost of Financing

Carefully evaluate the total cost of financing, including interest rates, fees, and any other charges. Compare the total cost of different financing options to determine which one offers the best value.

Payment Terms

Consider the length of the financing term and the frequency of payments. Ensure that the payment schedule aligns with your budget and cash flow.

Eligibility Requirements

Understand the eligibility requirements for each financing option, including any income or business revenue requirements.

Reputation of the Lender or Retailer

Research the reputation of the lender or retailer to ensure they are reputable and reliable. Read reviews and testimonials from other customers.

Contract Terms

Thoroughly review the contract terms before signing any agreement. Pay close attention to the fine print, including any penalties for late payments or early termination.

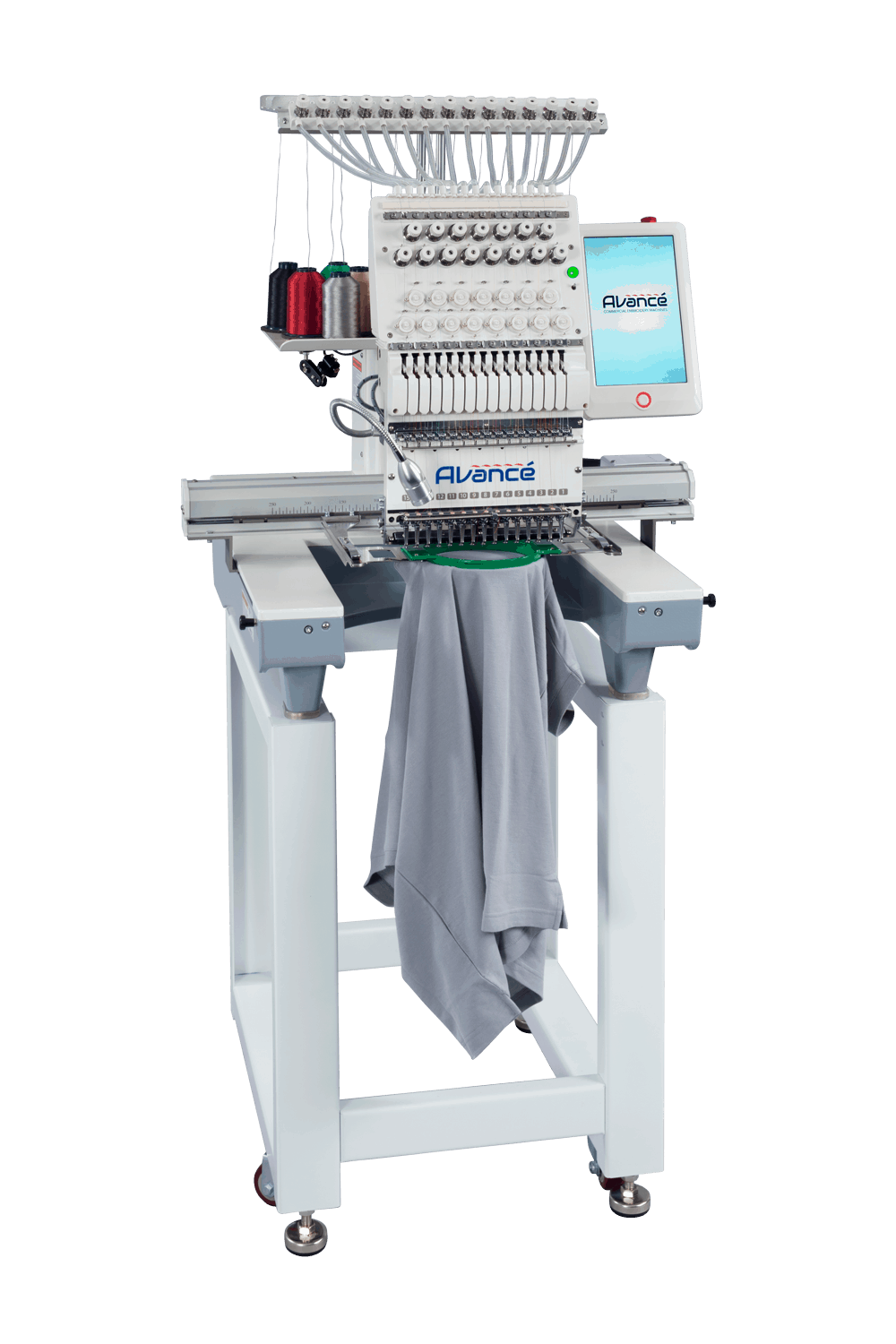

Machine Quality and Support

Ensure that the embroidery machine you are financing is of high quality and that the retailer or lender offers adequate customer support.

No credit check financing can be a valuable tool for building your embroidery business. By accessing the equipment you need, you can expand your product offerings, increase your production capacity, and attract new customers.

Start Small and Grow Gradually

Begin with a smaller, more affordable embroidery machine and gradually upgrade as your business grows. This approach allows you to manage your finances effectively and minimize your risk.

Focus on Niche Markets

Identify niche markets that are underserved by existing embroidery businesses. By focusing on a specific niche, you can differentiate yourself from the competition and attract loyal customers.

Build a Strong Online Presence

Create a professional website and social media profiles to showcase your embroidery work and attract potential customers.

Provide Excellent Customer Service

Provide exceptional customer service to build a strong reputation and generate repeat business.

Network with Other Embroiderers

Connect with other embroiderers to share knowledge, exchange ideas, and build valuable partnerships.

No credit check embroidery machine financing provides a viable pathway for individuals and businesses to access the equipment they need to pursue their embroidery dreams. By understanding the various financing options available and carefully considering the factors involved, you can make an informed decision and embark on a fulfilling and profitable embroidery journey. Remember that while no credit check options are available, it is always wise to try and improve your credit score, as this will open up more options for you in the long run.